Fri 05 November 2021

View all news

Finance Day

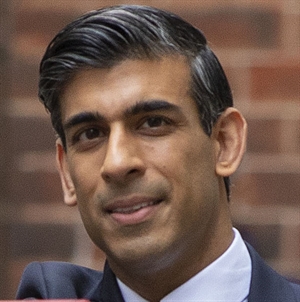

Former Bank of England Governor Mark Carney, the PM's finance adviser for COP26, Claimed a "watershed" moment in tackling climate change following the Chancellor Rishi Sunak announcement that $130 trillion of private capital was waiting to be deployed to deliver net zero.

Carney said: "Up until today there was not enough money in the world to fund the transition. And this is a watershed. So now, it's [about] plugging it in."

Earlier, Chancellor Rishi Sunak had announced an update on the Glasgow Financial Alliance for Net-Zero (GFANZ) under which 450 firms controlling around 40% of global assets have aligned themselves to the Paris Agreement 1.5C warming limit. According to the Chancellor, this 'unlocks' $130 trillion of private capital to fund the green transition. The total assets under management are up from $90trn at the start of October.

The Chancellor also announced to "rewire the global financial system for net-zero", outlining plans on sovereign green bonds and corporate climate disclosures.

He confirmed that a mandate for all large businesses and public enterprises to develop net zero transition plans by the end of 2024 will be introduced. He claimed this should be supported and adopted by all major economies with a net zero target in law. From 2023, large businesses in high-emitting sectors will need to meet the requirement. The Government, in collaboration with industry and other stakeholders, has developed what it says is a science-based ‘gold-standard' verification scheme to safeguard against 'greenwashing'.

Leaders from South Africa, the United Kingdom, the United States, France, Germany and the European Union have also announced a ground-breaking partnership to support South Africa with an accelerated just energy transition. As a first step, $8.5 billion can be made available over the next 3-5 years to support South Africa – the world’s most carbon-intensive electricity producer – to achieve the most ambitious emissions reduction target within its upgraded and ambitious Nationally Determined Contribution.

A key focus of discussions at COP26 has been the long-standing but yet-to-be-delivered international climate finance from OECD nations to developing nations, of $100bn in climate finance annually. The maximum provided in a single year so far has been $80bn and, due to Covid-19, wealthy nations believe the $100bn milestone will not be met this year. Rishi Sunak has said that the full $100bn will be provided in 2023, as part of a roadmap drawn up by the UK Government in collaboration with Canada and Germany.

Sunak's outlined his overarching vision; for the UK to become the world's first net zero financial centre, with all portfolios aligned with the net zero transition by 2050 at the latest. Under the proposals, there will be new requirements for UK financial institutions and listed companies to publish net zero transition plans that detail how they will adapt and decarbonise as the UK moves towards to a net zero economy by 2050.

COP26 President Alok Sharma said: "Today, there is more public and private finance for climate action than ever before.

"But to meet the commitments made in the Paris Agreement and keep 1.5 alive, we need developed countries to deliver on public finance, and to unleash the trillions required in private investment to create a net zero future and protect lives and livelihoods from the devastating effects of climate change."

Some news headlines from Day Three:

Related Links

< Back to news list