Company Car Tax: New rates, new savings...and new numbers

Mon 30 March 2020

View all news

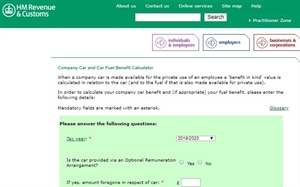

(LowCVP media release:) The way company car tax is calculated changes from 6 April 2020. For drivers of zero and some ultra-low emissions company cars there are very big savings to be had, so long as you have the right information.

Thanks to new company car tax bands coming into effect from 6 April, running a low or zero-emissions company car becomes dramatically more desirable in the 2020/21 tax year – and could be the moment many have been waiting for:

-

Drivers of zero-emissions models will now pay no benefit-in-kind (BIK) tax whatsoever, down from 16% currently.

-

On smaller electric cars such as the Renault Zoe, that equates to a £1,023 BIK tax saving for someone in the 20% tax bracket and a considerable £2,046 for a 40% taxpayer. If you’re fortunate enough to be driving a more premium model, such as the Tesla Model 3 Performance, the annual savings are enormous: £1,806 for a 20% taxpayer, and £3,612 for 40%*

-

Cars with CO2 emissions of 1-50g/km that are registered from 6 April 2020 will now pay between 0% and 12% BIK tax (also down from 16%). This is determined by not only the vehicle’s CO2 emissions, but also a new electric-only driving range figure.

Andy Eastlake, Managing Director of the Low Carbon Vehicle Partnership, said: “For any company car drivers who have been thinking of switching to a low or zero emissions car, now’s most definitely the time. These tax savings, on top of the already significantly lower running costs, make PHEVs and pure electric vehicles very hard to ignore. Actively encouraging company drivers is one of the fastest ways of transitioning our fleet to the zero-emissions target.”

Tim Anderson, Head of Transport at Energy Saving Trust added: “The imminent changes to the Benefit in Kind company car tax are an important step in supporting the increased uptake of electric vehicles. The important saving brought by the reduction of 16% to zero tax in 2020/21 makes an electric vehicle increasingly attractive for company car drivers. Petrol and diesel cars contribute 18% to the UK’s total carbon emissions. Electric vehicles play a central role in the decarbonisation of transport, and the improvement of air quality.”

Company cars registered from 6 April 2020 will use the new WLTP test procedure CO2 emissions number to determine the ‘benefit-in-kind’ tax payable, which replaces the previous, less realistic NEDC figure (which still applies for cars registered up to 5 April 2020).

As a result, this WLTP CO2 value is usually higher than before, even though the car’s emissions themselves have not changed. The benefit-in-kind tax bands have been adjusted to allow for some of this. The WLTP CO2 figure also takes account of a vehicle’s specification and the options fitted – and so is specific to that car. Company car drivers and fleet managers therefore need to ensure they have this individual CO2 number, as it will be required for future annual tax returns.

Company Car Drivers of plug-in hybrid cars with CO2 emissions of 1-50g/km now also need to know their WLTP-equivalent all-electric range (or zero emission mileage). This has not been asked for before. The higher the electric range, the less tax they pay. For example, a car with an electric range of 40 to 69 miles (registered from 6 April 2020) pays 6% BIK tax; but for an electric range of less than 30 miles, this doubles to 12%.

Where to find this new information?

A car’s CO2 figure is shown on the V5C registration document, or found by entering the registration number on the DVLA website: www.gov.uk/get-vehicle-information-from-dvla

It’s worth noting that while a new car’s V5C will show the new WLTP CO2 figure from 1 April, this should not be used for BIK until 6 April. Instead, all company cars registered between 1-5 April 2020 must use the NEDC CO2 value for company car tax calculations, which will still be included on the vehicle’s Certificate of Conformity (CoC) document.

Car leasing firms or fleet providers also supply this information – and should now begin to include a car’s official electric range too.

If you own the vehicle, the equivalent all-electric range figure can be found on the vehicle’s ‘Certificate of Conformity’; it’s therefore important you ensure this is provided with the car. If not, please talk to the supplier or manufacturer.

If, in extreme circumstances this information is not available, you can obtain the zero-emission mileage figure directly from the car manufacturer.

HMRC has issued further guidance for employers on reporting future company car tax data within its February 2020 ‘Employer Bulletin’ (Link)

* Benefit in Kind tax saving calculations as follows:

Tesla Model 3 Performance: P11D price £56,435; BIK tax 2019-2020 rate 16% = £9,029.60. Cost for 40% tax payer £3,611.84 and for 20% tax payer £1,805.92. BIK tax 2020-2021 rate 0% = £0; savings of £3,611.84 / £1,805.92.

Renault Zoe R135 GT-Line: P11D price £31,965: BIK tax 2019-2020 rate 16% = £5,114.40. Cost for 40% tax payer £2,045.76 and for 20% tax payer £1,022.88. BIK tax 2020-2021 rate 0% = £0; savings of £2,045.76 / £1,022.88.

For the full media release click here.

Related Links

< Back to news list